To improve your chances of loan approval, it’s wise to obtain a MyCTOS report and familiarize yourself with your credit score.

What is CTOS?

CTOS Data Systems Sdn Bhd (CTOS) is a top Credit Reporting Agency (CRA) in Malaysia. This private agency keeps a record of a person or company’s entire credit history. Unlike the CCRIS report, which covers a 12-month period, the CTOS report has no time limit. Banks and financial institutions in Malaysia use the CTOS report to evaluate a person’s or company’s creditworthiness and ability to repay loans.

Is MyCTOS Legal?

Yes, CTOS is legal. The Credit Reporting Agencies Act 2010 (CRA Act 2010) regulates credit reporting businesses. This law allows agencies like CTOS to collect and use your credit information to create a credit report, which assesses your creditworthiness. This report includes details like your history of paying bills on time or any past failures to do so.

What is a MyCTOS blacklist?

CTOS doesn’t have the power to blacklist anyone. They only provide credit information. The decision to approve loans is up to the creditors, banks, or financial institutions, who assess the risk themselves.

What is a credit score and how does it affect a home loan application?

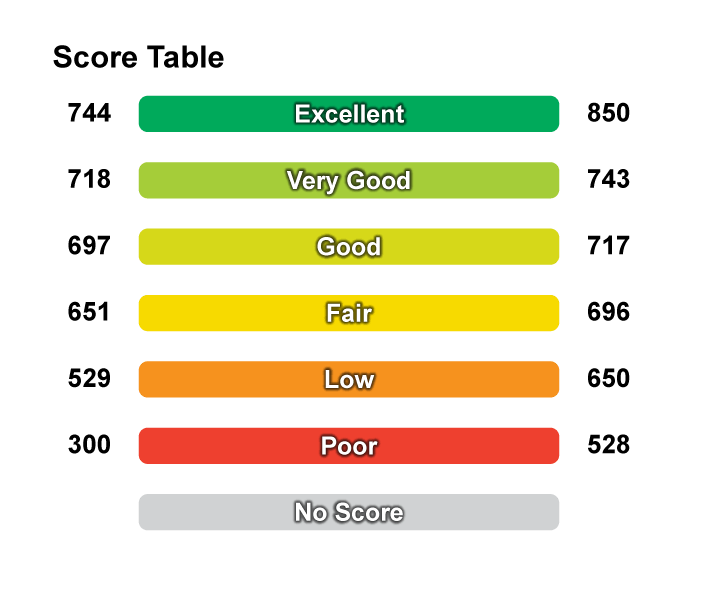

A credit score shows how risky it is to lend to you. It ranges from 300 to 850. The higher your score, the lower the risk. A good credit score can help you get a loan, better interest rates, and faster approval.

However, negative items and bad financial history can lower your score. Banks and lenders might not give you a loan if you often pay late or inconsistently. It shows you are not responsible with your finances. Always pay on time to keep your credit score high. Make sure to pay all your bills before their deadlines. If you’re planning to buy a property in JB or anywhere around Malaysia, you need to make sure your credit score is higher.

What is the difference between MyCTOS and CCRIS?

In Malaysia, financial institutions use different methods to evaluate your credit score. They often refer to two main credit reports: CCRIS and CTOS. CCRIS, run by the Credit Bureau of Bank Negara Malaysia (BNM), collects credit information from various financial service providers, including banks, insurance companies, and utility companies. CTOS is a private credit reporting agency. A CTOS score is based on information from both CCRIS and the CTOS database. The score ranges from 300 to 850.

What are the benefits of knowing your credit score?

Even if you’re not buying property, knowing your credit score is helpful. Here are some benefits:

- It shows you how lenders, banks, and financial institutions view you, indicating if you’re a high or low-risk borrower.

- Checking your credit score can alert you to errors, like late payments listed by mistake, so you can fix them early.

- Regularly checking your score can help prevent fraud. Any unexpected changes can signal unauthorized credit taken out in your name.

How often does MyCTOS update the credit report?

CTOS updates your credit report every month by gathering and refreshing your credit information regularly. If there is any incorrect information on your report, it can take 3 to 5 days to update. However, fixing more complicated issues might take over 2 weeks.

What affects MyCTOS score?

Payment History (45%)

This looks at whether you pay your loans on time or have missed payments. Late payments can hurt your credit score.

Amount Owed (20%)

This measures how much credit you are using compared to your available limit.

Credit History Length (7%)

This is the amount of time you have had a credit account.

Credit Mix (14%)

This considers the different types of loans you have, like home loans, car loans, credit cards, and personal loans.

New Credit (14%)

This looks at whether you have recently been approved for new credit.

How MyCTOS Works?

A ‘good’ CTOS Score is generally between 697 and 850. However, a lower score doesn’t always mean it’s ‘bad.’ When banks or lenders review your loan or credit application, they also look at other factors besides your credit score. The chart below shows what a CTOS score means to lenders.

How to Improve CTOS score?

Having a poor credit score isn’t the end of the world. You can improve your credit health and avoid loan rejection with some practical steps:

Pay Your Bills on Time:

If you tend to forget, sign up for auto-debit services and at least pay the minimum amount.

Keep Balances Low:

Avoid maxing out your credit limit. Be mindful when using your credit cards and don’t apply for new credit unnecessarily. Only spend within your limit. Remember, high balances can affect your score even if you make payments on time.

Consistency is Key:

There’s no quick fix for a credit score. Manage it responsibly over time.

Specific Situations:

– If your score is low because you’ve never had a credit card, it will improve each month as you use the card and pay your bills on time.

– Paying down balances improves your debt-to-credit ratio and raises your score.

– Adding an installment loan, like a car loan, changes your credit mix and can raise your score.

If you’ve regularly missed payments, declared bankruptcy, defaulted on a loan, or had a loan sent to collections, it can take years to rebuild your credit score. However, even in these situations, you can start improving your score by getting credit and making timely payments. If you’re looking for a new property in JB or any other states of Malaysia, keep in mind about your credit score.