When buying a property, your income is a key factor to consider. How much you earn affects the amount of home loan you can get approved for. Banks also look at other things when deciding on a mortgage loan, like your credit score (CCRIS) and debt service ratio (DSR). Your spending habits, payment history, and any outstanding debts impact your CCRIS. If your DSR is too high, your loan application could be denied.

How to Calculate Your DSR

The formula is:

(Total monthly commitments ÷ Net income) x 100% = Debt Service Ratio (DSR)

Example:

Total monthly commitments: RM500 (car loan) + RM200 (PTPTN) + RM300 (credit card) = RM1,000

Net income: RM4,500

So, (RM1,000 ÷ RM4,500) x 100% = 22%

Your DSR should ideally be no more than 30–40%. However, some banks might still approve your loan even if your DSR is as high as 70%.

Average Incomes in Malaysia and Home Loan Affordability

The Department of Statistics reported that the median household income in Malaysia was RM6,338 in 2022. However, there is a big gap in median household income between urban and rural areas, as shown in the table below.

What Property Can You Afford Based on Your Income?

The property you can afford depends on your income and financial situation. It’s important to do your research and talk to a financial advisor to understand your options clearly. There’s no point in looking at properties that are out of your budget, right? Fortunately, there are many online mortgage calculators available to assist you, like the CIMB Property Affordability Calculator or the Maybank Home Loan Calculator.

With these calculators, you’ll find out if you can afford your desired property, or if you need to consider a cheaper one or increase your down payment. It’s also good to remember that your income can change over time. If you expect it to rise, you can factor that into your decision.

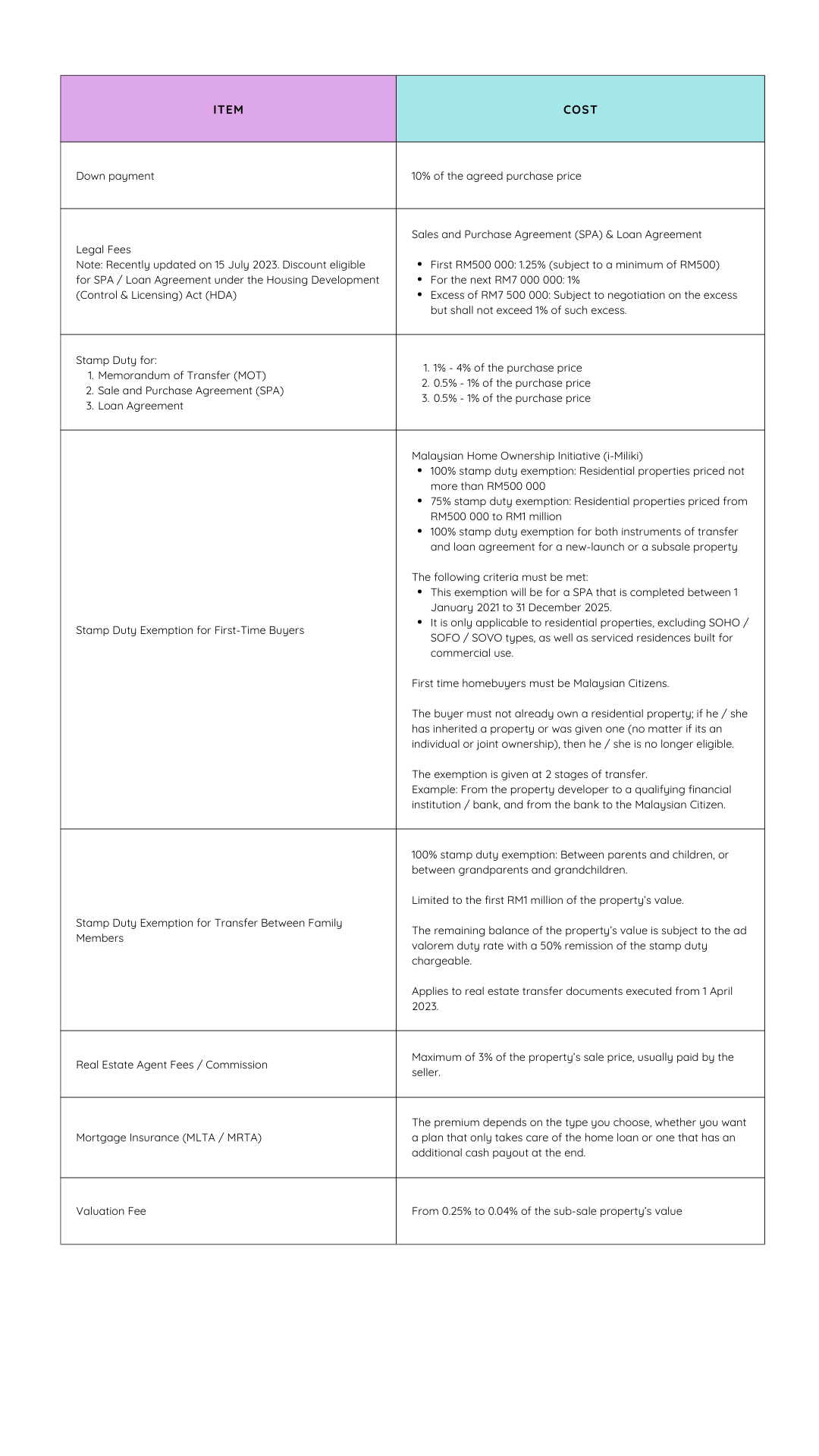

Extra Costs of Owning a Home

Unfortunately, buying a property comes with more expenses than just the purchase price. Here’s a quick overview of some additional costs you’ll need to consider.

Here are some simple tips for managing your money when buying a property in Malaysia:

- Get Pre-Approved for a Mortgage:

Before you start looking for a house, get pre-approved for a mortgage loan. This will help you understand how much money you can afford to spend. -

Think About Your Long-Term Plans:

Consider how long you plan to live in the property. Are you looking for a long-term home or planning to move in a few years? -

Include Other Expenses:

When figuring out how much you can spend on a mortgage, remember to include other costs like utilities, transportation, and food. -

Negotiate the Price:

The asking price is just a starting point. You might be able to negotiate a lower price, especially if the property has been for sale for a while.